Table of Content

- Talk to one of our Rumson NJ Real Estate Attorneys to Craft an Action Plan for Selling your Home as an Out-of-State Resident

- If I sell my house, do I pay capital gains tax?

- Division of Taxation

- New Jersey Sales Tax and You: An Overview

- Do I pay property tax when I sell my house?

- How much are transfer taxes in New Jersey?

That said, the support of a real estate attorney is absolutely invaluable. We also may spare you a sour deal by ensuring that the buyer’s terms are in alignment with the worth of your home. Some homeowners will owe capital gains tax on selling a home if they don’t qualify for an exclusion or special circumstance. Generally speaking, it’s easier to minimize or eliminate capital gains taxes on a primary home than a vacation or rental property. The frequently asked questions section about gross income tax on real property transfers on the Division of Taxation’s website says that if you qualify for the gain exclusion, you can be exempt from this withholding tax, Wolfe said.

In addition to typical closing costs on the sale, as a seller you will have to pay a realty transfer fee, which is generally under 1% of the sale price. Seniors pay a lower rate, said Matthew DeFelice, a certified financial planner with U.S. In New Jersey, there are many details involved in the sale of a house. These often less obvious procedures are essential for the transfer of property to be considered legal. Things get even more complicated when the seller of the home is not a New Jersey resident. Read on to learn more about requirements for a seller who is not a legal resident of the state and why it’s important to have a real estate lawyer on your side.

Talk to one of our Rumson NJ Real Estate Attorneys to Craft an Action Plan for Selling your Home as an Out-of-State Resident

The form is completed by the grantor, transferor, buyer, grantee, or authorized representative. The tax rate is variable (from $2 to $6.05 for every $500 of a home’s value) and scales the more expensive a home is. Sellers are in charge of paying this amount, though buyers will have a partial tax due for home purchases above $1,000,000. You’re probably asking about the capital gains exclusion — the Section 121 exclusion — on a home sale.

If a service results in an exempt capital improvement, the property owner must provide the contractor with a fully completed Certificate of Exempt Capital Improvement (Form ST-8) to claim the exemption. A capital gain is the profit you realize when you sell or exchange property such as real estate or shares of stock. If you are a New Jersey resident, all of your capital gains, except gains from the sale of exempt obligations, are subject to tax. While some real estate contracts can be drawn up so that the buyer is responsible for paying all or some of the transfer taxes, in New Jersey, it's 100% the seller's responsibility.

If I sell my house, do I pay capital gains tax?

You say you have an offer of $90,000 for your New Jersey house. From this, you subtract sales commission paid to your real estate agent, legal fees you paid and realty transfer fees, Kiely said. When a purchaser claims a tax exemption on a sale, she or he must provide each seller with a tax exemption certificate. Different certificates are required for different types of sales. Capital gains and losses must be reported in the year they are realized. Gains from installment sales must be reported in the same year that you report them on your federal return.

It is for information purposes only, and any links provided are for the user's convenience. Please seek the services of a legal, accounting or real estate professional prior to any real estate transaction. It is not Zillow's intention to solicit or interfere with any established agency relationship you may have with a real estate professional.

Division of Taxation

All GIT/REP forms are required to be personally certified first hand, by way of their own signature or that of another individual with written authorization using a power of attorney or letter of authority from the seller/grantor. It is the responsibility of the buyer/grantee or that of his/her/their authorized representative to be sure a GIT/REP form is completed at the time of closing. The appropriate county clerk will not accept a deed for recording unless accompanied by a properly completed and signed GIT/REP-1, -2 or -3 form. Failure by either party to comply with this procedure is not a basis for seeking a GIT/REP-4 waiver. However, in those instances when it is impossible to obtain the seller's/grantor's signature, the Division will consider a request for a waiver.

If you sold your primary residence, you may qualify to exclude all or part of the gain from your income. Your capital gain is calculated the same way as it is for federal purposes. Any amount that is taxable for federal purposes is taxable for New Jersey purposes. This is true regardless of age, as long as you owned and lived in the residence for 2 of the 5 years prior to the sale.

Find your taxable amount

When you calculate the gain or loss from each transaction, you can deduct expenses of the sale and your basis in the property. The basis to be used for calculating gain or loss is the cost or adjusted basis used for federal income tax purposes. This affidavit lists the name of any other mortgagees and other holders of encumbrances and the current balance of all prior mortgages, liens, or encumbrances constituting consideration. Nonresident sellers who don’t qualify for an exemption in NJ are subject to an additional fee, paid during the closing or shortly before. The nonresident grantor would complete a GIT/REP-3 form and check off #6 under seller assurances (The total consideration for the property is $1,000 or less . . .).

Such transactions are treated in the same way as any other transaction between individual parties. The forms can be obtained at one of our regional offices or at the link for Buying, Selling, or Transferring Real Property in New Jersey. The effective date for requiring the filing of the GIT/REP forms was August 1, 2004. If you sell a home worth $400,000 using Clever Real Estate, you'll save around $8,000 in listing commission fees. For instance, if your home sells for $400,000, you'd be taxed at $3.90 per $500 of value for the first $350,000 and would use the following guide to determine how the remaining $50,000 would be taxed. By choosing a Clever Real Estate agent, you'll pay just 1% listing commission (or $3K for homes under $350K) to sell your home.

If you converted a rental property into your primary residence, your basis would be the lower of your original purchase price or the fair market value of the home on the date you converted its use. You will still increase the basis by any money spent on improvements. Based on all of this, the entire $100,000 gain would be subject to income tax for both federal and New Jersey tax purposes, Hook said. He said the state requires all real property owners to execute a special tax form that must be attached to all deeds upon the sale of the property. The seller/grantor must attach a copy of a completed W-7 TIN application form to the GIT/REP-1 form to be submitted with the deed for recording with the appropriate county clerk. Connect with our concierge team to get paired with a top agent that knows the ins and outs of your local transfer taxes — all for a low 1% listing fee.

The sale of a non-primary residence isn’t eligible for the exclusion and will be taxed at capital gain rates, he said. That would be based on the difference between the selling price and the cost of the property, factoring in home improvements and less depreciation, if taken, he said. A 1031 exchange allows you to roll over profits from a second home sale into another investment property within 90 days of selling and defer capital gains tax liability. This is a complicated process that requires an intermediary to manage the rollover, and you’re required to follow specific guidelines.

If you sold an interest in a partnership, a sole proprietorship, or rental property, you may be required to use a New Jersey adjusted basis. If you sold shares in an S corporation, you must use your New Jersey adjusted basis. RTF-1 Sellers must file the Affidavit of Consideration (RTF-1) with any deed in which they claim a full or partial exemption from the RTF. The instructions to the RTF-1 list the full and partial exemptions from the RTF. “If you have a gain even after applying the exclusion, you would pay tax both at the federal and New Jersey state level,” he said. First, if you have a primary home in New Jersey for which you paid $200,000 and are selling for $275,000, you need to look at Form GIT/REP3 - Seller's Residency Certification/Exemption for New Jersey Resident Taxpayers.

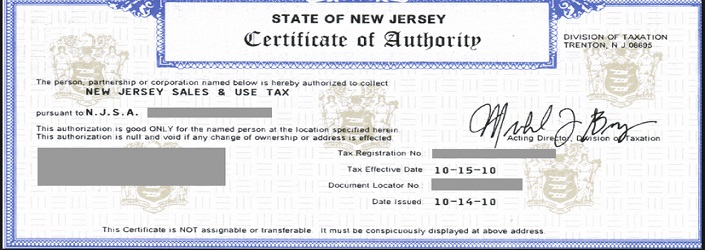

If your mortgage lender handles your property tax payments for you, you can expect to see the amount as a line item in your payoff settlement statement. As a seller of taxable goods or services, you are required to be registered with the New Jersey Division of Revenue and Enterprise Services. Once registered, you must display your Certificate of Authority for Sales Tax (Form CA-1) at your business location. This is your permit to collect Sales Tax and to use Sales Tax exemption certificates.

If you won’t qualify for any capital gains tax exemptions, it’s best to know how much you’ll owe ahead of time so you have a better idea of your final profit. When you buy items or services in New Jersey, you generally pay Sales Tax on each purchase. The seller (a store, service provider, restaurant, etc.) collects tax at the time of the sale and sends it to the State. When buying, selling, or transferring real property in New Jersey, taxpayers should be aware of certain taxes, fees, and/or procedures that may arise in connection with the transaction. This page provides links for assistance with regard to the GIT/REP, Realty Transfer Fee , Controlling Interest Transfer Tax , and Bulk Sales.

This fee is considered a tax filing, and as such, the seller does not receive any part of the fee back unless they have overpaid the required state tax. Gross income is the total amount of your earned and unearned income that is considered taxable by the Internal Revenue Service and is not initially exempt from taxation according to the Internal Revenue Code. When a person sells a home in New Jersey, the sale obviously becomes part of the person’s gross income. The seller/grantor must fill out the appropriate GIT/REP form based on his/her/their residency status. All nonresident estates and trusts are required to check the box indicating NJ-1041.

No comments:

Post a Comment